Global Alternative Finance Report | University of Cambridge

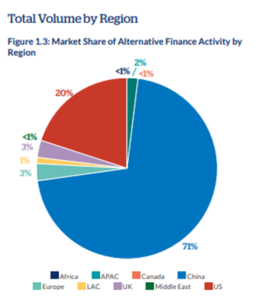

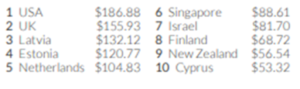

The alternative finance market has significantly grown from 2017 to 2018 on all the continents, with a total transaction volume of USD 304 billion in 2018. The largest market belongs to China, followed by the US and the UK. On a per capita basis the US has the largest transaction volume, followed by the UK, Latvia, Estonia and the Netherlands. This demonstrates that countries with smaller overall online alternative finance volumes may still have greater market penetration, higher adoption and usage of these models.

Geographically, the main contributor to alternative investments in Europe is the United Kingdom, which accounts for 57% of all European markets, reaching $10.4 billion. However, this imbalance might decrease with Brexit. UK platforms are increasingly active on the continent as well and are keen to establish footholds outside the British market given growing concerns over Brexit.

As far as continental Europe is concerned, Continental Europe’s growth is dominated by Western European countries headed by the Netherlands, followed by other Benelux countries, Germany, and France.

Among them, the Benelux region’s growth rate overwhelmingly (98%) results from the growth of debt-based models ($ 1.8 billion), while equity-based (1%, $ 26 million) and non-investment (1%, $ 17 million) account for the remaining volume. This is the first time that the alternative finance volume in the Netherlands has exceeded $ 1 billion

Among them, the Benelux region’s growth rate overwhelmingly (98%) results from the growth of debt-based models ($ 1.8 billion), while equity-based (1%, $ 26 million) and non-investment (1%, $ 17 million) account for the remaining volume. This is the first time that the alternative finance volume in the Netherlands has exceeded $ 1 billion

.

On the other hand, from 2017 to 2018, the German alternative finance market grew to $1.28 billion, at a growth rate of 90%. This volume makes it the third-largest volume in Europe after the UK and Benelux, the same position it held after the UK and France in 2017. Unlike the UK and the Benelux countries, only 69% of the total volume in 2018 is a result of debt-based activities ($882 million). $351 million (28%) have been raised on platforms intermediating equity instruments, $42 million (1%) on non-investment models.

In France, $ 647 million (70%) have been raised through debt-based models, $ 225 million (24%) came through equity instruments, $ 55 million (6%) through non-investment instruments. After the UK, France has the second-largest alternative finance market for non-investment instruments.

Eastern European countries (Poland, the Czech Republic, Slovakia, and Hungary) have significant share of donation-based crowdfunding, with non-investment models contributing $ 23 million (6%) to the overall volume, whereas equity-based models are negligible with $ 3 million (1%). Debt-based models contribute $ 387 million (93%) to the market in Eastern Europe, a noteworthy development in countries which have hitherto lacked a robust equity-based sector. The regional engine here is Poland, accounting for 80% of regional volumes. In 2018 their alternative market volume reached $ 414 million. These markets exhibited a growth rate of 104% from $ 202 million from 2017, a reduction in the previous 153% growth rate from $ 78 million in 2016. We can understand that equity crowdfunding has a lot of room for development in the region.

Overall, the commercial volume of debt-based crowdfunding is leading in various regions of Europe. However, high risk investments in early-stage start-ups such as equity crowdfunding are also catching up in the past two years.

Equity-based Crowdfunding in the UK is supported by a liberal regulatory framework and tax incentives that promote early-stage investments. Therefore, it is not surprising to find the British Equity-based Crowdfunding as having the highest volumes, at $484 million in 2018. Finland, which also has a healthy ecosystem for start-ups, had an Equity-based Crowdfunding, market volume of $68 million, which is about 14% of the volume of British Equity-based Crowdfunding. Swedish Equity-based Crowdfunding ranks third with $60 million (12%), and Spanish Equity-based Crowdfunding ranks fourth with $48 million (10% of the British market).

Alternative finance includes more women than traditional channels

For almost all types of firms surveyed, female participation, whether as a fundraiser or a funder, is below 40%. Notable exceptions to this are non-investment crowdfunding models; 47% of fundraisers, and 45% of funders to Reward-based Crowdfunding are female, as are 70% of fundraisers for Donation-based Crowdfunding. The proportion of female funders is less than 30% for the most financial-return models, including P2P Property Lending (26%), Debt-based Securities (28%), and Equity Crowdfunding (22%). Such distribution corresponds well with historical research which consistently finds that women exhibit greater caution and lower risk tolerance in comparison to their male counterparts.

Despite persistent gender gaps, these findings indicate that overall, females take larger share of investment in alternative channels than in traditional ones. At the same time, a larger share of funding raised via alternative channels reach women than in traditional channels. For example, a study by Pitchbook reported in Fortune Magazine indicated that all female founder teams received just 2.2% of VC investments in 2017.