Overview of the European Crowdfunding Market

Source: TokePortal.com, December 12, 2022

Author: Álmos Mátravölgyi

2021: A Record Year

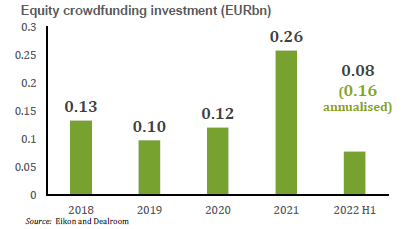

According to industry data from EBAN, the investment-oriented crowdfunding market set a new record in 2021, with over 250 million euros raised solely in the European market. This figure is more than double the amount from 2020. Data from the first half of 2022 suggests that while this year may not set new records, it will still surpass the 2020 figures. A primary driver of market growth has been the EU crowdfunding regulation, effective from this year and mandatory from November 2023, which has spurred a wave of consolidation and acquisitions.

The ECSPR Regulation as a Catalyst for Acquisitions

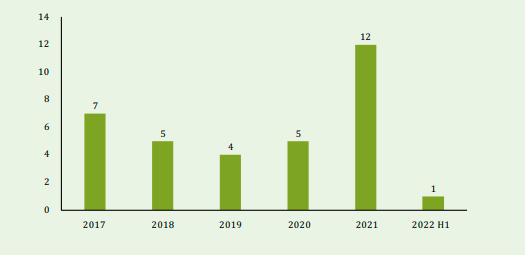

The enactment of the ECSPR regulation was expected to increase competition, as its stated goal is to stimulate the market. This new regulatory framework, which allows for cross-border (passporting) services, has triggered a wave of acquisitions. It’s no surprise that the crowdfunding market has entered its next phase due to intensified competition among platform providers. Dealogic data shows that in 2021, 12 acquisitions were announced in Europe within the crowdfunding services sector, compared to 5-7 per year in the previous four years. Additionally, non-European entities have also acquired European platforms or made strategic investments, while others have begun expanding their activities.

Market Dynamics and Future Prospects

Looking at this year’s figures, a decline can be observed, mainly because last year saw a rush to finalize deals due to strict licensing deadlines, which the European Commission extended by one year to November 10, 2023. This extension has reopened the door for further negotiations, and acquisitions have resumed. For example, in the second quarter, we reported on the acquisition of the neighboring Romanian Seedblink by Symbid and the expansion of the Finnish Invesdor-Oneplanetcrowd, neither of which are included in this year’s data yet. The market is expected to gain momentum again next year. Consolidation trends and increased competition will contribute to the rapid development of the market in the coming years. However, the success of the reform across the EU depends on practical implementation.

Sources:

https://www.afme.eu/Portals/0/DispatchFeaturedImages/AFME%20CMU%20Key%20Performance%20Indicators%20Report%20Nov%2022.pdf?ver=2022-11-16-133135-940

https://www.esma.europa.eu/sites/default/files/library/esma35-42-1183_final_report_-_ecspr_technical_standards.pdf