The Role of Special Purpose Vehicles (SPV) in Crowdfunding

2022.04.12. – TokePortal.com’s own content

Imagine you, as a campaign manager, have just raised, for example, €257 225 (100 million HUF) in your crowdfunding campaign. That’s the good news. But what comes next? Post-campaign, you have many, potentially hundreds of shareholders, which can complicate and extend administrative tasks at the campaign’s conclusion, such as general meeting decision-making administration, and mainly future capital raising. Institutional investors later do not favor long, complicated cap tables, even though the crowd’s share does not reach a controlling interest.

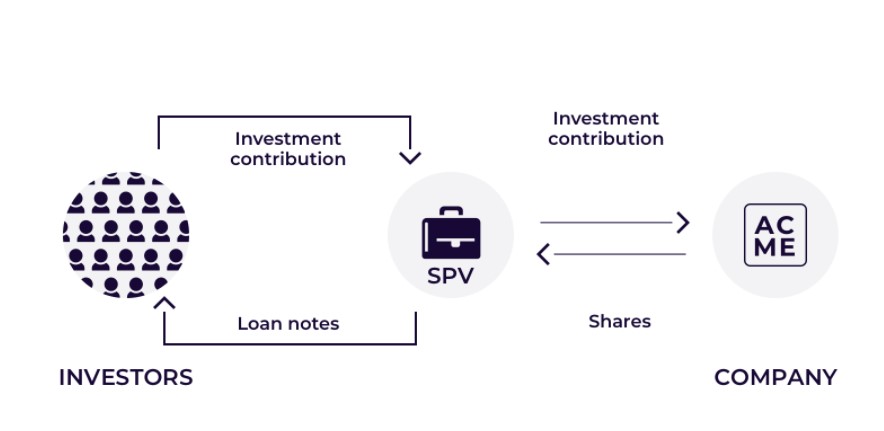

The simpler the shareholder structure, the more transparent, manageable, and cheaper it is. Hence, one way to avoid the above risks is for the capital-seeking enterprise (the target company) to carry out the capital increase through an SPV. The investors’ capital is placed into a corporation established solely for the purpose of making a single investment in the target company, and the investors become shareholders in this SPV. Following the registration of the SPV’s capital increase, it invests the entire capital into the target company, thus the target company only adds one new shareholder to its cap table. The operating costs of the SPV are low and predictable, but the target company ensures its operational viability, as the SPV does not manage a portfolio but makes a single predetermined investment. (This distinction is significant as portfolio management requires a license.)

The ESMA guidelines issued in relation to the ECSP regulation have confirmed the applicability of SPVs in crowdfunding offers.

The purpose of the SPV is to enable the campaign manager to receive investments even if the target asset is indivisible or immobile. To launch a crowdfunding campaign without restructuring the company, an ultimately independent SPV is established to make the campaign manager investment-ready through securities issuance.

Moreover, the SPV allows investors to obtain the same economic exposure, voting rights, and legal rights as if they had invested directly in the underlying asset, and their shares remain transferable. Thus, although operational costs need to be covered, the SPV structure protects investors’ interests well in the long term.

SPVs within the ECSP Regulation Framework

Through an SPV, only transferable securities can be offered, defined under MiFID II Article 4, paragraph 1, point 44 as:

- Shares and equivalent securities, as well as depositary receipts for shares;

- Bonds and other forms of securitized debt, including depositary receipts for such securities;

- All other securities giving the right to acquire or sell transferable securities, or allowing for cash settlement determined by reference to transferable securities, currencies, interest rates or yields, commodities, or other indices or measures.

Under Article 3, paragraph 6 of the ECSPR, an SPV cannot serve to offer exposure to more than one illiquid or indivisible asset to investors. Therefore, an SPV can invest in only one project owner company, even in multiple rounds.

An asset is considered illiquid if it cannot be converted into cash within a “usual” time frame and at market price on the given market. Typical reasons for illiquidity include:

- Lack of an organized, regulated market, meaning the asset can only be sold over-the-counter;

- No immediately available market price;

- Significant costs incurred when negotiating the sale price with potential buyers (administrative fees, taxes, audit, and legal costs), and the negotiation and execution are not organized or predictable.

An asset is deemed indivisible if it cannot be easily or quickly divided into smaller units with established pricing for partial or full sale to investors, or if such division is not economically feasible.

International Examples

Hungarian legislation (the Bszt) also recognizes the use of SPVs (as securitization companies). In the EU, platforms operating under local laws actively use SPV structures in equity and loan-based crowdfunding offers, including the Estonian Funderbeam and the Italian BacktoWork examples.

Funderbeam: The SPV-Loan Model

In Funderbeam’s SPV structure, investors provide loans to the SPV by subscribing to debt securities issued by the SPV, with returns linked to the target company’s value. The SPV invests the aggregate loan amount into the project owner’s company under the agreed investment terms. Each project owner has a unique SPV. Successful campaigns result in only one new shareholder (the SPV) for the project owner, instead of individual investors becoming shareholders.

BacktoWork

In Italy, specific financial legislation regulates crowdfunding, allowing investors subscribing to shares/equity through a crowdfunding platform to authorize a qualified intermediary to subscribe shares on their behalf. This method enables the intermediary (e.g., an investment company) to become the “formal” owner of the equity (for LLCs) or shares (for corporations) and commit to maintaining specific internal records. Investors retain all rights associated with the equity in the given company.

BacktoWork partners with the Italian investment company Directa SIM, enabling investors to participate in crowdfunding campaigns initiated by LLCs. Directa SIM’s involvement simplifies and reduces the cost of equity sales for investors, eliminating the need for notaries and accounting professionals during equity sales. Investors must open an account with Directa SIM, costing 15 EUR for individuals and 80 EUR for legal entities. Once the account is opened, investors must enable the Crowdfunding option.