Venture Capital Investments in the Shadow of Global Economic Risks

05.25.2022. – Tokeportal.com, own content

Author: Ádám Ubrankovics

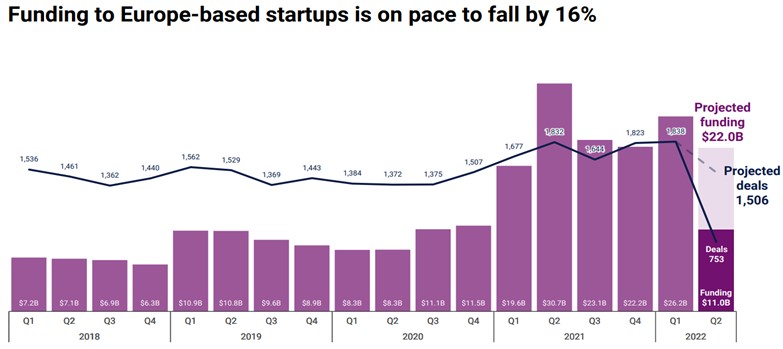

The financing of European startups is expected to decline by 16%, as stated in the report. Concerns regarding the decline of public markets and geopolitical uncertainties dampening investor appetite indicate that investments in European technology companies cannot keep up with the record pace of 2021.

The total financing was largely driven by the “megarounds” raised by European fintech startups, including Checkout.com, Qonto, and Scalapay. Although even in the thriving fintech sector, the total number of deals decreased compared to the same quarter of the previous year, suggesting a slowdown in financing.

Source: CB Insights „State of Venture”

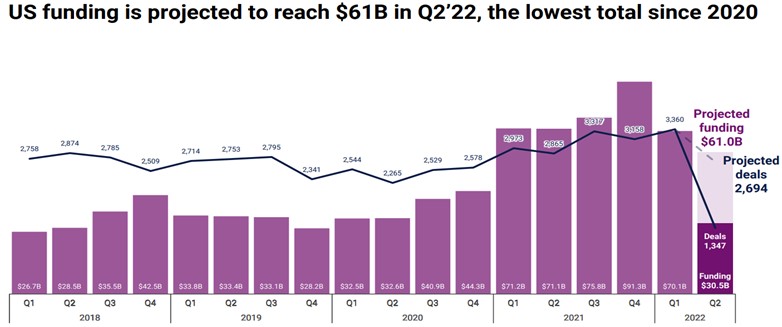

Despite the lower value of first-quarter deals compared to 2021 in every quarter, the number still surpassed quarterly figures from before 2021, dating back to 2010. Analysts at PitchBook believe that venture capital deal activity will likely show a delayed reaction to the slowdown in public markets, and this trend should be monitored in the upcoming quarter.

Source: CB Insights „State of Venture”

Asia’s venture capital market is not immune to the global decline in financing either. Asian startup ventures, which had raised $12.7 billion so far, are expected to experience a 31% drop in financing this quarter. The continent’s venture financing fell to $36.6 billion in the first quarter, a 7% decline compared to the same quarter of the previous year.

Asia has to face more headwinds than the United States, perhaps to an even greater extent. China, the continent’s largest venture capital market, is still grappling with the COVID crisis as the new Omicron variant spreads and causes increasing disruptions in the supply chain.

Source: CB Insights „State of Venture”

Y Combinator, the renowned startup accelerator in Silicon Valley, advised all portfolio company founders to plan for the worst and prepare for an economic downturn in the next 30 days by reducing costs and expanding their services. In a note, Y Combinator stated that if a company wants to raise money in the next 6-12 months, they should do it at the peak of the downturn.

While most venture capital firms warn their founders about the slowdown in financing, they also believe that resilient companies will weather this period.

Which sectors are suffering the most?

“The fintech, digital health, and retail technology sectors are expected to experience the sharpest decline – with a 50% decrease in retail technology financing being the highest,” according to the CB Insights report. Globally, investors signed approximately 1,443 deals in the fintech segment in the first quarter of 2022, which is likely to decrease to around 1,038 in the second quarter. So far, approximately 519 deals have been signed in the fintech segment in the second quarter, while about 891 have been signed in retail.

Meanwhile, for the first time since 2020, there will be fewer than 100 unicorns in a quarter. It is expected that only 62 startups will become unicorns in the second quarter. The United States and Asia will be the most severely affected, with a projected decline of 43% and 67%, respectively, in the number of companies with a valuation of $1 billion. Initial public offerings (IPOs) are also drying up as public markets remain volatile. According to the report, only 92 companies are expected to go public in the quarter, which represents a 34% decrease compared to the previous quarter and marks a quarterly low point in nine years.

The sign of a slowdown in venture capital investments clearly emerges in the second quarter as investors reassess the situation in light of inflation, the conflict in Ukraine, a weak IPO market, and the possibility of a recession.