Woman-power in business, investments, and crowdfunding

08.03.2022. – Tokeportal.com’s own content

One of the main problems in thinking about female entrepreneurs is that the role of an entrepreneur is stereotypically considered masculine. Despite there being fewer female investors in numbers compared to men, several studies show that they perform better in terms of realized returns. This trend is particularly evident in the crowdfunding market, where female-founded startups are much more successful and can attract more capital through crowdfunding campaigns.

Regarding female investments in general...

The number of female investors is growing, but the investment world remains predominantly male-dominated. According to the YouGov Omnibus survey, more than half of women have never had any investments, while this is true for only 37% of men. This can be attributed to various reasons, with the most frequently mentioned ones being lack of confidence, lack of financial knowledge, and being overwhelmed.

Stereotypically, female investors are considered more risk-averse than their male counterparts. This may be due to the fact that while men tend to treat their investments as their own and manage them with pleasure, women are more inclined to view their savings as part of the family’s wealth, even when it comes to their own investments. As a result, they tend to shy away from risky investments and are more likely to keep their savings in cash. In reality, however, they tend to make decisions later but are more persistent and ethical, ultimately being more risk-tolerant than men!

One of the reasons for this delay can be attributed to a lack of self-confidence. The survey revealed that only 13% of women believe they have sufficient financial knowledge about investments and the stock market. Additionally, the limited free time due to fulfilling the role of a family caretaker plays a role in women having less time to focus on financial planning.

This mindset has been changing in recent times: A study by Qartz showed that the number of female investors is increasing. Moreover, female investors possess more thoughtful and reliable investment strategies compared to men. Since women are less competitive with each other in this area compared to men, there is also a lower chance of them pushing each other into riskier investments in pursuit of higher returns. Due to this female consistency, they are less likely to think short-term and jump in and out of different assets in the hope of higher profits; instead, they tend to think long-term.

These findings are fully supported by data from the investment application called Stash. Based on the data of hundreds of thousands of users, the conclusions drawn indicate that although women often consider themselves risk-averse, their actual behavior does not always reflect this.

During registration, the application asks users what level of risk (low, medium, or high) they are willing to take in their investments. At this point, 90% of women and 75% of men choose low to medium risk assets. However, the practice reveals something different. In reality, there is no noticeable difference in risk appetite between female and male profiles; both hold stocks in their portfolios to the same extent (15%). However, during market fluctuations and volatile times, the behavior of the two genders differs. In such situations, men are 87% more likely to sell their investments, realizing losses, while women are more likely to hold on despite market downturns and wait until the market recovers.

Back in 2020, the Financial Times reported a record number of registrations on various trading platforms by private investors, with women showing the most interest in the stock markets. The European investment platform Bux also reported similar data for the same period: the number of new female clients increased sixfold, while for men, it was only fourfold. Of course, the lower initial base for women plays a role, but it is a good indicator of what to expect in the coming years.

As a woman in the world of entrepreneurship...

To launch a new venture, entrepreneurs require a multitude of resources and support to overcome initial challenges successfully. Unfortunately, there still exists a gender gap in the entrepreneurial sphere, meaning that women do not have equal access to these resources. In the United Kingdom, for every 10 male entrepreneurs, there are less than five female entrepreneurs (although social enterprises perform much better in this regard). Additionally, women typically start their ventures with 53% less capital than men. Globally, only 2% of venture capital went to female founders in 2018.

One central finding of Alison Rose’s research, specifically focused on female entrepreneurs, was that the lack of sufficient funding hinders women entrepreneurs the most. To address this issue and ensure the growth of female-led businesses, new sources of financing had to be established. For example, the UK’s Enterprise Fund was launched for this purpose, thanks to an exciting partnership between the Business Growth Fund and Coutts. At the EU level, programs supporting female founders, such as Woman TechEU, have also been initiated.

So far, the best way to secure funding has been through networking. This approach involves a very exhausting process of seeking investors, attending numerous meetings, and often enduring condescending attitudes from men as a woman. Many still hold the stereotype that women cannot be good leaders and lack understanding of finances and business like men. Numerous female entrepreneurs report negative experiences, prompting them to seek alternative financing options instead of venture capital funding.

The search for investors is also challenging for women because, according to All Raise, 88% of decision-makers in venture capital firms with assets over $25 million are male. Moreover, this group is a very closed circle.

Securing funding also means that investors have to be won over not only by the idea but also by the personality of the founder. If the founder is a woman, and the idea is related to a product or service that the investor has no experience with, failure is almost guaranteed. Nevertheless, many female entrepreneurs have successfully raised hundreds of millions of dollars from various investors, indicating that stereotypes about female founders are fading.

However, the unanimous consensus is that the best way to address implicit gender bias is by increasing the number of women in decision-making positions. Female leaders, such as Pippa Lamb, are still a minority in venture capital firms, but they are increasingly taking on decision-making roles at the corporate level.

In the realm of crowdfunding, it appears that campaigns led by women perform better than their male counterparts. But why is that?

Women's success in crowdfunding

Crowdfunding essentially involves financing a project with the involvement of a large number of crowd investors within a specific period. There is a widespread belief that crowdfunding democratizes the financing sector—and it seems to be the case. Crowdfunding has opened up opportunities for female founders, allowing them to bypass stereotypes and the male venture capital investors mentioned in the previous points. They no longer have to join male-dominated clubs to access financing. For many, crowdfunding has become the most suitable financing method from a gender equality perspective, and over time, the success rate of crowdfunding campaigns has increased more for female founders than for men. A PwC study from 2017, analyzing more than 450,000 seed crowdfunding campaigns, showed that women are 32% more likely to achieve their goals compared to men.

There are several reasons for this. Many believe that women approach crowdfunding campaigns more holistically. For them, capital raising is not just about Excel spreadsheets; they better understand the benefits of community building, possess business acumen, and know how to effectively use various social media and mass media tools to present their business ideas. Why? Because they often had to work much harder than their male counterparts to prove that their business is worthwhile and deserving of investment.

Investors prefer to be part of the success and are more likely to join a campaign with a mission that resonates with them. Therefore, if a female founder has a sufficient customer base (network), she is more likely to run a successful campaign. Instead of having to convince an arguably unrepresentative group, she can communicate directly with potential investors. Thus, businesses founded by women can access capital through community validation.

In recent years, large organizations have also begun to notice the success of female founders in crowdfunding. For example, NatWest provides additional financing through the Back Her Business initiative to those female entrepreneurs who successfully completed their crowdfunding campaigns. Crowdfunding platforms also offer extra support for female-founded businesses to support their growth. Crowdcube is a good example of this: by 2019, 216 female-founded ventures had successfully raised capital through the platform.

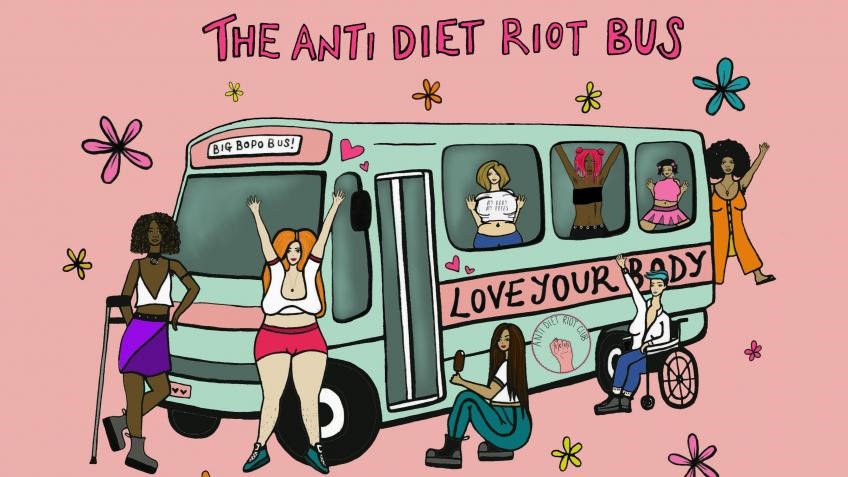

Source: https://www.crowdfunder.co.uk/p/anti-diet-riot-bus

The Anti Diet Riot Club (pictured above) is a positive example of a social enterprise founded by women that received funding both from crowdfunding and extra financing from NatWest. They raised £16,270 from 264 backers to purchase a bus and convert it into the Anti Diet Riot Bus. The bus supports their work and events promoting the fight against the diet industry and the promotion of body positivity. As a UK-based female-founded social enterprise meeting NatWest’s match-funding criteria, they managed to secure an additional £5,000 in their campaign.

Another successful example of a female-founded, crowdfunding-based startup is the German sustainable fashion brand Silfir. In early 2019, they raised over €30,000 from 221 supporters on Kickstarter to produce their first collection. Founder Hannah Kromminga received support from around the world. For Hannah, crowdfunding was an extremely effective way to test and promote her product idea. As she puts it:

“It allows you to present your product within the crowdfunding community with low risk.”

The 3 most important tips:

Last year, 75% of our clients at Crowdfund 360 were female founders. We not only see that their crowdfunding campaigns are successful, but we also witness how their overall confidence grows, and how their projects evolve – highlighted the platform’s founder and CEO. Overall, crowdfunding can help female founders both in launching their businesses and expanding them. Considering the following three tips is essential for successful crowdfunding:

- There’s no need to exclude anyone from your network, as support often comes from unexpected places, even from individuals whose helpful intentions weren’t apparent before.

- Honesty is crucial when it comes to strengths and weaknesses: emotions and passion should be reflected in your communication.

- Actively seek collaborations with corporate partners and other businesses. This can promote external validation of your project and increase the number of potential investors, thus raising the size of the funding.

Female entrepreneurs, female investors, apply now!

Sources:

- https://natwestbusinesshub.com/articles/women-in-business-how-crowdfunding-can-improve-access-to-finance

- https://natwestbusinesshub.com/articles/female-entrepreneurship-the-post-pandemic-landscape

- https://www.natwestgroup.com/news/2021/03/alison-rose-review-female-entrepreneurship-the-story-continues.html

- https://theconversation.com/how-women-led-companies-can-raise-more-money-through-crowdfunding-168808

- https://www.origo.hu/gazdasag/20211028-befektetes-hozam-portfolio-no-ferfi.html

- https://www.uzletnoknek.hu/befektetesek/miert-keves-a-noi-befektet%C5%91

- https://g7.hu/elet/20180919/a-noi-befektetok-kevesebbet-panikolnak-mint-a-ferfiak/

- https://qz.com/work/1386775/study-of-investors-shows-differences-between-men-and-women/

- https://yougov.co.uk/topics/politics/articles-reports/2018/04/12/over-half-women-have-never-held-investment-product

- https://www.portfolio.hu/befektetes/20201202/elleptek-a-nok-a-befektetesi-platformokat-ritkan-latni-ilyet-459978

- https://www.ft.com/content/36d9d064-d259-4d45-a637-fe2114c630e1

- https://www.uzletnoknek.hu/befektetesek/miert-sikeresebb-eredmenyesebb-befektetok-a-nok

- https://theconversation.com/how-women-led-companies-can-raise-more-money-through-crowdfunding-168808

- https://www.pwc.com/gx/en/about/diversity/womenunbound.html

- https://www.pioneerspost.com/business-school/20200305/how-crowdfunding-gives-women-edge-business